Introduction

Platinum is a precious metal, like gold, silver, rhodium and palladium.

It is white to grayish-white in color, with a metallic sheen, and shiny.

It was used in pre-Columbian America, as well as probably in Eurasia. However the first European reference appeared in 1557.

The Hispanic Conquistadors immediately named the metal "platina" (little silver) when they discovered it in native form in present-day Colombia.

Platinum's unique physical and catalytic properties established its value in industrial applications.

Unlike gold, platinum production is much less distributed across the globe. In 2021, only five countries were responsible for 96% of platinum production: South Africa (74%), Russia (10%), Zimbabwe (7%), USA + Canada (5%).

According to the World Platinum Investment Council, platinum is thirty times more rare than gold.

In 2021, mines produced 3500 tons of gold against 175 tons of platinum.

In 2021, 1150 tons of gold were recycled against 56 tons of platinum.

Industrial applications

Automotive industry

This sector accounts for the majority of platinum demand (37% of total demand in 2021). Platinum is used in catalytic converters to reduce harmful emissions from exhaust systems.

It will be important to monitor whether new car sales remain depressed due to delivery delays and loss of purchasing power.

Chemical industry

Also acting as a catalyst, platinum is essential to the production of many industrial, agricultural and household chemicals. For example, nitric acid, which is used to make nitrogen fertilizers essential to agriculture, nylon, polyurethane and many other plastics.

Electronics/Electrics

Platinum enabled the late 20th century revolution in digital data storage. It is used in hard drives and many electrical connectors.

Glass manufacturing

To contain and channel molten glass, tools capable of withstanding temperatures of 1500°C are required. Platinum is therefore an ideal material since its melting point is 1768°C.

Oil

In the oil industry, platinum is also used as a catalyst to transform and improve the quality of fuels.

Medical and biomedical

Stents, catheters, defibrillators and all pacemakers use platinum components because, like gold, it does not react with chemicals in human tissue, but is much stronger than the yellow metal.

The potential of platinum in the treatment of cancer was discovered in the early 1960s. Commercial production of cisplatin-based drugs began the following decade and the search for new treatments continues today.

Other industrial uses

Platinum is resistant to corrosion and very high temperatures. It is an ideal material for a wide range of industrial sensors and laboratory equipment.

Platinum is also used in jet engines, high-performance spark plugs, fuel cell technology and we're probably not done discovering new hidden talents.

Naturally, platinum is used extensively in jewelry (26% of total demand in 2021).

But while jewelry demand has been trending downward since 2013, we see the opposite for industrial demand, which is seeing the largest change between 2013 and 2021 (+60%).

Investment demand

Investment in platinum is a very recent option when compared to gold and silver used for jewelry, coins and ingots for thousands of years.

This is reflected in the somewhat erratic figures of a still immature investment demand.

Indeed, investment demand reached a record high in 2020 with 44 tons before falling back to 6.3 tons in 2021, mainly due to a lack of interest from ETFs.

It is true that in 2020, the price of platinum had gained +70% between its March low and its November high.

According to the World Platinum Investment Council, investment demand for physical platinum (coins and ingots) was 16.5 tons in 2020 and 10.3 tons in 2021, or 7.6% and 5% of total demand, respectively.

Industrial, chemical and technological uses currently dominate the market.

We will continue to watch closely the evolution of investment demand for platinum, which is still far below that of gold and even silver.

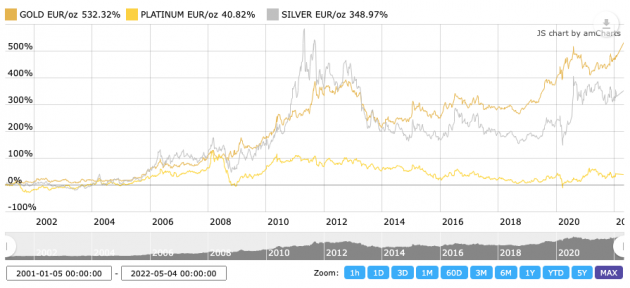

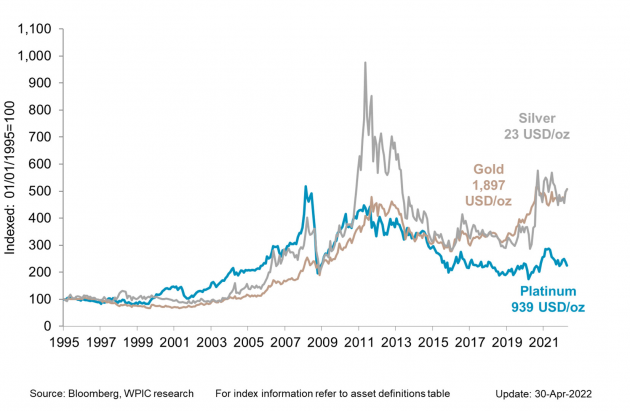

Graphical analysis

On the charts below, we see the difference between gold (predominantly monetary), silver (monetary and industrial) and platinum (predominantly industrial).

Source: kitco.com

Source: Platinuminvestment

Let's take a closer look at the price between its 2010 peak and today.

Source: Tradingview

The peak zone corresponds broadly to that of gold and silver (2010-2011).

After that, platinum entered a long bearish channel, more pronounced than gold and silver.

Indeed, where gold bottomed in December 2013, platinum continued to dig in 2015, 2018 and 2020.

But by the end of 2020, we see it break the average Bollinger Bands and the bearish channel to the upside.

It made a high in February 2021 and seems to be consolidating since then, with a slightly bullish trend as it holds the ascending support of the average Bollinger bands.

The Bollinger Bands are tightening to the horizontal, indicating a healthy consolidation before potentially continuing the bullish leg to seek the 2010 high.

Conclusion

Platinum may have a bright future ahead of it if it catches up to its former 2010 high.

It should be considered as a diversification tool for a real asset portfolio, but the differences in behavior with gold should be carefully studied.

We will be watching supply and demand closely given the industrial dominance of platinum.

But the investment demand is still young and in a context of structural decline of the euro and generalized monetary risk, it could quite develop in the future.

>>> Discover now our 100 grams platinum ingots!

PS: We offer you the possibility to order them in case of stock shortage.

The GFI team

--

Disclaimer:

The data presented on this page is provided for information purposes only and does not constitute investment advice, an offer to sell or a solicitation to buy, and should not be relied upon as a basis for/or inducement to engage in any investment.

Past performance is not constant over time and is not indicative of future performance. This newsletter does not take into account your financial situation and objectives. The investor is the sole judge of the appropriateness of the transactions he/she may enter into.

The information on this website is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For more information about Gold and Forex International: see the Terms and Conditions.