The EU's sacrifice

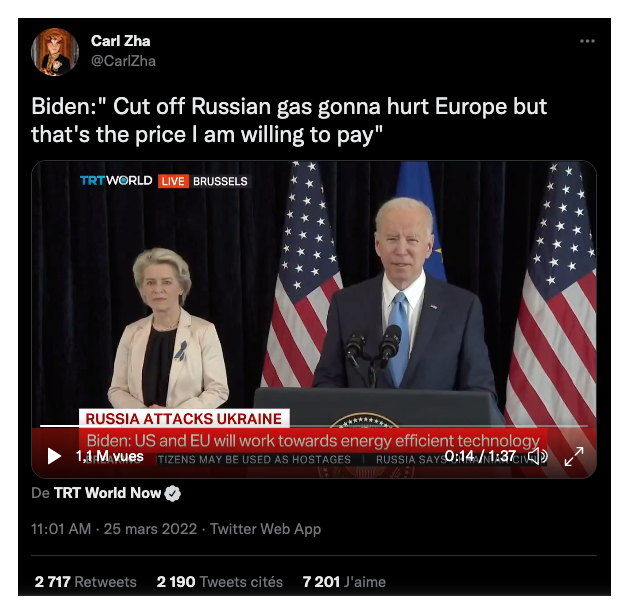

The European Union is about to experience extremely difficult times. Joe Biden has stated this openly. He is ready to make Europe suffer if that is the price to pay.

Source: TRTWorld

Be prepared, because the EU is likely to face very big difficulties. We support the policy of the USA, we put ourselves in danger against the new powers of the 21st century instead of developing a multipolar world and we could be the first victims.

The total war

Finland announced its intention to join NATO. Dmitry Medvedev immediately responded that this represented a risk of open conflict and escalation to nuclear war. NATO is doing everything to make the situation even worse. Why? (Source: Newsweek)

The rate hike

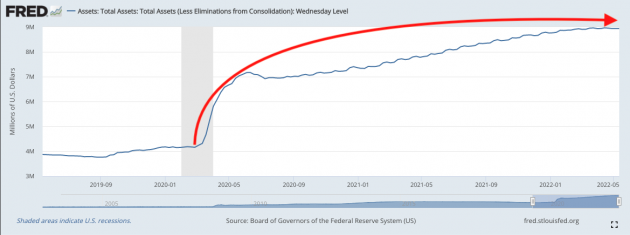

In early May, the Fed's rate hike caused quite a stir. It was the largest rate hike in 22 years. But a 1% rate to counteract 8.3% inflation won't be enough. The Fed is announcing additional rate hikes, but there is no guarantee that it will be able to do so. And if it does, what will be the consequences?

In any case, for the time being, the Federal Reserve is slowing down its asset purchases. We see its balance sheet stabilizing around $8.942 trillion after having increased by 115% since the beginning of the pandemic in March 2020!

Source: fred - FED Balance Sheet

While we wait to see rates at 10% to seriously counter inflation, we will have plenty of time to experience the deleterious effects of even the slightest rate increase.

Inflation rose from 8.5% in March to 8.3% in April. Will the FED be able to contain inflation?

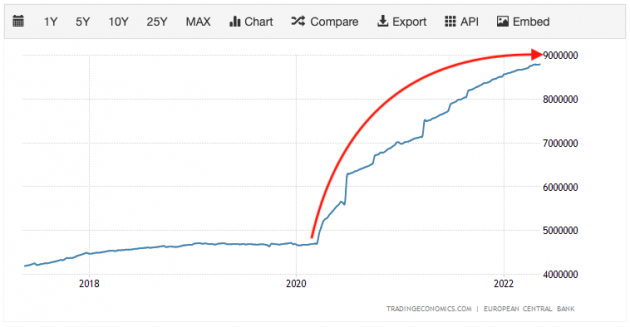

On the ECB's side, we have also recently seen its balance sheet stabilize at around 8.8 trillion euros with an interest rate that remains at 0% for the time being.

Source: tradingeconomics - Balance Sheet ECB

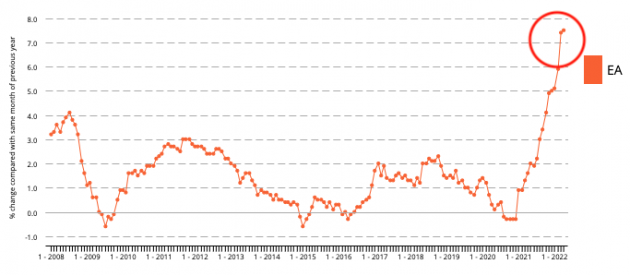

Inflation in the Eurozone

In the Eurozone, inflation was 7.5% in April and, unfortunately, there is no sign that monetary policy tightening will be able to counteract it.

Source: Eurostat

Shortages are becoming a reality

They are becoming more and more serious.

Source: Fortune

Rising energy prices and war are causing fertilizer shortages and this is very bad news for agriculture in Europe.

Recently, India banned wheat exports. It is the 2nd largest producer in the world!

Source: CNBC

Shortages may very soon not be limited to semiconductors for the automotive industry. At this stage, we do not yet have a good enough idea of the real impact of real shortages in Europe.

The dollar in good shape

The DXY dollar index is breaking a high that dates back to January 2017.

Source: tradingview

If this increase is confirmed, it will put pressure on other currencies, especially the Euro.

The consequences

These rate hikes and monetary policy tightening put all assets under pressure. Markets are addicted to easy money and these floods of liquidity have created a kind of widespread bubble.

Even crypto-currencies are collapsing. Bitcoin has lost more than 50% since November 2021 and for other cryptos it's even worse.

Source: tradingview

Equity markets are correcting. The S&P500 is down 20% from its January 2022 high before rebounding slightly, but the decline may not be over.

Source: tradingview

On the chart, we see how marginal the 2008 crisis looks compared to the subsequent rise on steroids and the size of the correction that could occur.

Bonds are also correcting. In the past, we used to arbitrage between stocks and bonds to reduce risk. But now both are falling at the same time. The US 10-year yield is going up, so the value of bonds already issued is going down as the new ones are paying more. The value of bonds varies inversely with the rise in rates and the rate has doubled since the beginning of the year.

Source: tradingeconomics

Even real estate is slowing down, as Bart Van Opstal, spokesman for the Belgian federation of notaries (Fednot) points out. "It could well be that the extreme increases in volume and prices are behind us," he adds. (Source: immovlan)

The reform of the sector that the government is preparing for us prompts us to be very cautious. On the agenda, taxation of real rents and capital gains regardless of the year of purchase, compulsory energy renovations, rate increases...

In this context, it may be time to diversify!

Commodities are consolidating, but holding their own.

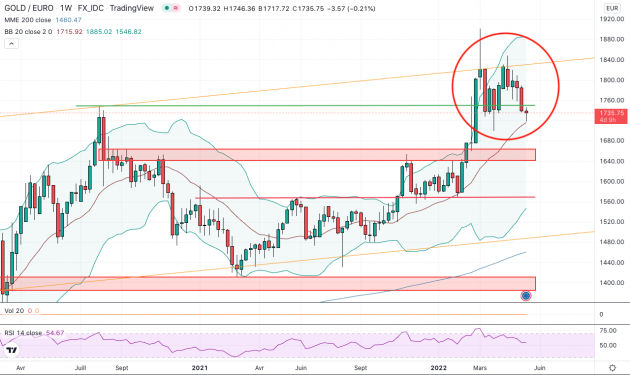

Gold is also consolidating, but remains at significant levels.

The yellow metal is testing the support of the average of the Bollinger Bands. It has dropped 8% from its March 2022 high of €1901 to trade around €1730, but it remains wisely in its box for now at fairly high levels.

Source: tradingview

We would like to see it consolidate sideways as the Bollinger Bands tighten before starting the next bullish leg.

We'll keep you posted on how the ultimate safe haven is doing, as the environment is very uncertain.

The GFI team

--

Disclaimer:

The data presented on this page is provided for information purposes only and does not constitute investment advice, an offer to sell or a solicitation to buy, and should not be relied upon as a basis for/or inducement to engage in any investment.

Past performance is not constant over time and is not indicative of future performance. This newsletter does not take into account your financial situation and objectives. The investor is the sole judge of the appropriateness of the transactions he/she may enter into.

The information on this website is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For more information about Gold and Forex International: see the Terms and Conditions.