Inflation: incompetence or malice?

“I think we now understand better how little we understand about inflation… This was unpredicted.”

These were the words of Jerome Powell, President of the US Central Bank, at the ECB Forum on Central Banking in Sintra, Portugal, that took place at the end of June. You have to pinch yourself to believe it, but it reveals how completely unmanaged the situation is and that it is not going to get any better.

In the Eurozone, inflation is breaking a record for the third month in a row, settling at 8.6% in June 2022.

"Surprisingly," this somewhat contradicts the rhetoric of the ECB and its president Christine Lagarde that inflation was only "transitory."

In practical terms, this puts more pressure on households, on growth that is already in great difficulty, and on a possible debt crisis in the euro zone, given the dangerously widening interest rate gap between the North and the South.

What about the stock market?

The S&P 500 (US flagship index) lost 25% between January 2022 and June 2022.

Source: Tradingview

On a weekly basis, the index has bounced off the support of the MM200 (200-day moving average in green). This is very close to a support zone around 3600-3550.

For the moment, we can't talk about a real crash, but uncertainty reigns supreme. Inflation numbers and speeches, monetary tightening announcements, credit spreads, the specter of recession and headlines in the mainstream business press urging young people to go into the stock market for a better return should make one very cautious.

It must be recognized that a real purge would be salutary to clean up this hypertrophied market "addicted" to money creation, but it would not be without great pain.

“ALL IN” on Bitcoin?

Bitcoin lost 72% between November 2021 and June 2022.

Source: Tradingview

On a weekly basis, BTC is on an important support zone around 17,000 euros, which corresponds to its high in late 2017 and the psychological level of 20,000 dollars. After this peak, BTC entered the so-called "crypto winter", which lasted three years.

BTC has already hit this level once in mid-June and is currently trading around 19,000 - 20,000 euros.

Like the stock market, BTC is at a crossroads and will have to make an important decision.

The healthiest thing would be for it to find its bottom at these levels and calmly consolidate in preparation for a possible new bullish momentum.

If it goes back up too quickly, it will not have built up any energy and the upside will only be less reliable.

And with BTC, that can hurt a lot!

So, for now, the risk is very high here too.

And what about gold?

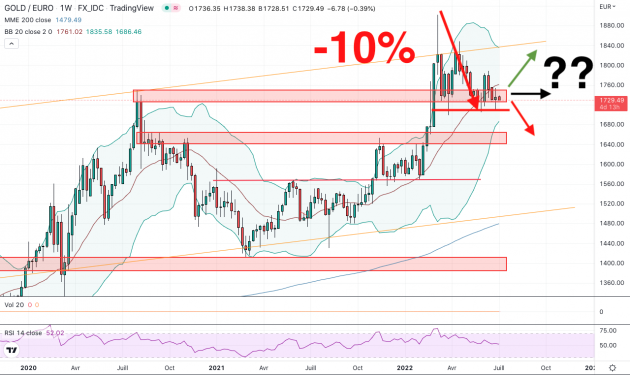

In this highly explosive environment, the euro-denominated yellow metal has only lost 10% since its March 2022 high and is up 7.5% in euro terms (0% in USD) since the beginning of the year.

It is holding up very well compared to stocks and Bitcoin.

Source: Tradingview

For the moment, not much is happening. It is wisely continuing its consolidation around 1.750 euros per ounce.

On the weekly chart, we can see the Bollinger Bands (green area) tightening, which is a very good thing for the future.

Volatility is also tightening and with an RSI close to 50, we can expect a consensus on the price.

The yellow metal started a new long-term bullish leg in June 2019 to confirm it in early 2020.

Given the global context, the odds are extremely favorable for a continuation of this bullish momentum.

The best thing would be for it to consolidate a little more sideways before moving higher again to give the Bollinger Bands time to tighten up properly.

And even if gold were to correct further to the support zone around 1.650 euros, this would not at all call into question the long-term bull market.

For that is the whole point of the physical yellow metal: to be part of a long-term protection strategy in times of serious monetary troubles.

For the record, the underlying trend remains the same in US dollars, but the analysis of the consolidation would be a little less clear, as the greenback is in very good shape against the euro.

Conclusion

Risk increases and uncertainty grows!

To keep a cool head and not panic, it may be best to adopt the KISS "Keep It Super Simple" strategy, i.e. to simplify things as much as possible.

In this sense, it is useless to try to "time" the market.

You can read analyses from experts on all sides:

"Will gold go up? Will it go down? Is it too late to buy?"

"The yellow metal is negatively correlated to the stock market indices, but beware not always..."

What matters is the Big Picture!

This allows you to identify the underlying trend and comes down to asking yourself a fundamental question:

Do you think the crisis is over? Don't buy gold.

Do you think it's not? Buy gold now.

The GFI team

--

Disclaimer:

The data presented on this page is provided for information purposes only and does not constitute investment advice, an offer to sell or a solicitation to buy, and should not be relied upon as a basis for/or inducement to engage in any investment.

Past performance is not constant over time and is not indicative of future performance. This newsletter does not take into account your financial situation and objectives. The investor is the sole judge of the appropriateness of the transactions he/she may enter into.

The information on this website is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For more information about Gold and Forex International: see the Terms and Conditions.