So there will be no return to an accommodative stance, as opposed to what some had anticipated.

Well... not yet.

The markets are therefore expecting a ¾ point increase in fed funds rates at the end of the next Fed meeting at the end of September.

Since then the S&P 500 index has lost nearly 6.5%. The yellow metal is down about 2%.

On the ECB side, several members of the central banks have argued this weekend for a sharp increase in rates next month to prevent a sustainable anchoring of inflation.

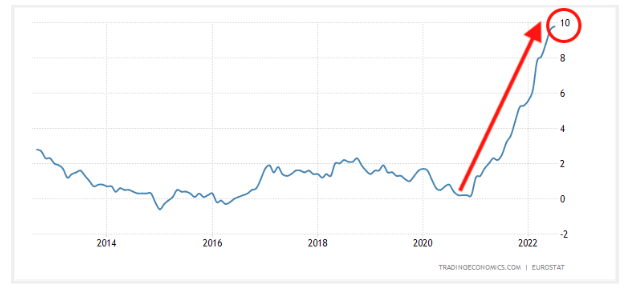

Inflation that approached 10% in the European Union in July!

Source: consumption price index - tradingeconomics/eurostat

Inflation is now at its highest level since March 1976!

It is largely due to high energy prices. Energy inflation ("imported inflation") now stands at 49.81%.

The US dollar is at its highest level since the 1970s.

Alas, we see that we are caught between a rock and a hard place.

For if a significant rise in interest rates saved us from inflation in the 1970s and 80s, there was not the problem of government debt that we have today. Countries like Italy, whose next elections are expected with great attention, are already suffering from an astronomical debt (150% of GDP in 2022 vs. 104% in 2007) at the risk of creating a new debt crisis in the euro zone... Not to mention Greece (190% of GDP) or France (114%).

If rates rise too much, recession is guaranteed and there is a risk of bankruptcy for many borrowers, which would bring down the debt house of cards. Monetary tightening in the US is faster than in Europe, which is once again lagging behind. Inflation in the US is more the result of a dynamic economy and a labor market that continues to perform well with a historically low unemployment rate (3.7%). Europe, on the other hand, is suffering from imported inflation driven by high energy prices, a real hurdle with no end in sight... Many European companies are having to slow down their production facilities in order to save energy, which is likely to exacerbate the economic slowdown and push us into a recession. Household energy bills are going to be a drag as well...

And monetary tightening to curb inflation could seriously hurt stock markets.

But if the central banks reactivate the money printing machine to save the system, we will have even higher inflation and higher price increases!

The yellow metal is under pressure, but for now, it remains in its consolidation range. The next supports to watch closely are around 1675 euros and especially 1650 euros. The current evolution of long rates with a US 10-year rate of 3.26% (2.15% for the Belgian 10-year OLO) and the strengthening of the US dollar is accelerating the downward pressure on gold. Until when? The next ECB meeting will be crucial to understand the monetary policy of the coming months...

"From a multi-asset perspective, equities could suffer as inflation remains high and the Fed is more likely to surprise with hawkish rhetoric”, she warns. Commodities, on the other hand, are the best asset class to hold during a late-cycle economic phase when demand remains higher than supply." (Goldman Sachs in The Echo, August 29, 2022)

>>> Start saving in physical gold now!

The GFi team

--

Disclaimer:

The data presented on this page is provided for information purposes only and does not constitute investment advice, an offer to sell or a solicitation to buy, and should not be relied upon as a basis for/or inducement to engage in any investment.

Past performance is not constant over time and is not indicative of future performance. This newsletter does not take into account your financial situation and objectives. The investor is the sole judge of the appropriateness of the transactions he/she may enter into.

The information on this website is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For more information about Gold and Forex International: see the Terms and Conditions.