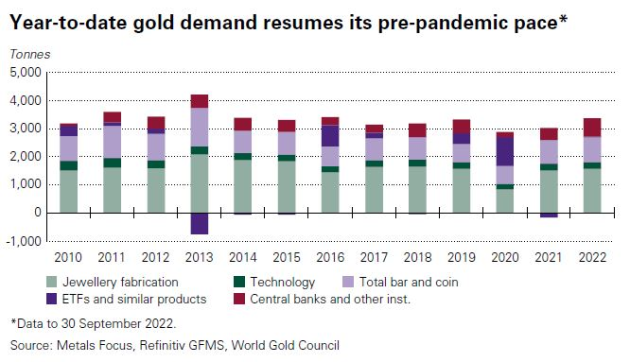

The WGC's quarterly report shows a 28% year-over-year increase in global gold demand.

Overall, gold demand has returned to pre-pandemic levels.

It also tells us that central banks made a record purchase of 399 tons of gold in Q3 2022, which is almost double the previous record of Q3 2008 of 241 tons.

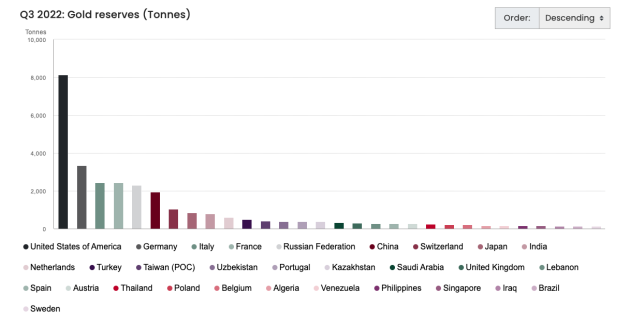

We know that gold is a strategic asset of the utmost importance in international relations, so much so that we do not know who the buyers are for 75% of those 400 tons.

Of course, this is not new. Official institutions do not always declare their gold holdings publicly or do so with a time lag. Some of the purchases recorded between July and September may have started earlier.

In reality, we cannot say anything for sure.

According to the WGC, Turkey remains officially the largest reported buyer of gold this year. It now has nearly 500 tons, including 31 tons acquired in Q3.

Other countries have declared purchases to the International Monetary Fund (IMF):

Uzbekistan (+26 tons of gold)

India (+17 tons)

Qatar (+15 tons)

Mozambique (+2 tons)

Philippines (+2 tons)

Mongolia (+1 ton)

There are still 300 tons for which we do not know who the real buyers are.

Officially, the United States still holds the largest reserves with some 8,000 tons of yellow metal.

China remains very secretive about how much gold it buys. In 2015, the country had declared the acquisition of nearly 600 tons of gold. But since 2019, the Chinese government has not indicated any gold purchases. This year, it has reportedly already imported 902 tons of gold.

Russia has increased its production since 2000. It has increased from 142 tons to 363 tons in 2021. But since the invasion of Ukraine, Russian gold is no longer welcome in the West. There are rumors that the Russian central bank is buying back this gold. Nevertheless, its official gold and currency reserves have been declining this year.

We could also think of the Gulf States, such as Saudi Arabia as potential buyers. They could convert some of the revenues from rising oil prices into gold.

Source: World Gold Council

In any case, this is only a reminder of the crucial importance of gold and, perhaps, an indication that the various states are preparing for a major shock in the current global monetary and financial system.

>>> Act like the central banks by owning physical gold

--

Disclaimer:

The data presented on this page is provided for information purposes only and does not constitute investment advice, an offer to sell or a solicitation to buy, and should not be relied upon as a basis for/or inducement to engage in any investment.

Past performance is not constant over time and is not indicative of future performance. This newsletter does not take into account your financial situation and objectives. The investor is the sole judge of the appropriateness of the transactions he/she may enter into.

The information on this website is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For more information about Gold and Forex International: see the Terms and Conditions.