Welcome to the "First Steps to Investing in Gold" series. In this first serie, we are going to address a crucial question: why should we invest in gold? If you are interested in investing but don't know much about it, don't worry. We will use simple and easy terms to guide you in this exciting adventure. You have probably heard of gold as an attractive asset and a safe haven. But what makes gold so special and why should you consider investing in this precious metal ?

In this inaugural article, we will reveal to you the reasons why gold is a wise choice for both small and large investments. The gold investments have always attracted the interest of investors around the whole world due to its valuable nature and consistent reputation. So in general, we consider that a good investment portfolio must contain a share of physical gold, regardless of the magnitude of the amount.

We will therefore cover topics such as portfolio diversification, preservation of capital, protection against inflation and economic uncertainty, as well as the liquidity and accessibility of gold as an investment. You discover the reason why gold is often considered a rock strong in a turbulent financial world.

Get ready to dive into the fascinating world of gold investing, where you will learn how to leverage this valuable asset to strengthen your portfolio and achieve your financial goals. Hang on, because the adventure begins now!

The timeless gold

First, gold offers a stable intrinsic value. For thousands of years, it is a sought-after active ingredient thanks in particular to its unique physical properties and to its rarity. Like our banknotes currently, which are ultimately based on a fictional value system, gold is a chemical element that cannot be created artificially. Paper currencies allow us to lead the economy that we know, but gold is solid and durable over time. He is also resistant to corrosion and does not degrade, which makes it an object long-term store of value.

To choose is to renounce

Common sense tells us that you should never "put all your eggs in the same basket”. Your investment portfolio is your egg collection. Gold is one of your baskets. Seen like that, it seems obvious to diversify.

Yet most people only treat themselves to one basket, when they could, they also collect them. See instead: Gold has an inverse correlation with other assets, such as stocks and bonds. This means that it can act as a hedge against market fluctuations. When these are volatile or falling, gold tends to rise in value, which helps to compensate for potential losses in other areas and to protect your investments. So, by adding gold to your baskets of assets, you reduce the risk of your portfolio and increase your chances of realizing returns long term stable. So, no need to walk on eggshells anymore…

Impervious to seizures

In the face of past, present and unfortunately future economic uncertainty, gold is perhaps your best ally. In times of crisis, when the markets stock markets fall or currencies lose value, gold tends to maintain its stability and protect your wealth, thereby acting as a lifeline for any prudent investor. Its tangible character and its ability to retain its value makes it an attractive asset and a safe haven when times are tough. Investing in gold means making a strategic choice of protection against economic uncertainty.

Generally speaking, in the event of a major financial crisis, gold acts as an insurance against currency and market collapse, providing an investment security.

Intractable inflation

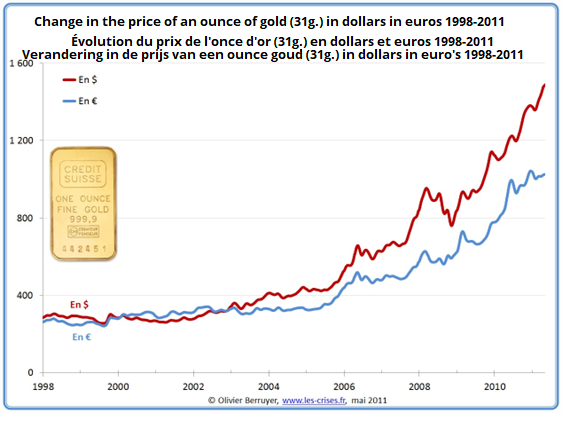

Beyond the economic uncertainties, there is the omnipresent inflation. To put it simply, when the value of a currency decreases, the price of gold tends to increase. On the other hand, when inflation increases, gold generally maintains its purchasing power thanks to its limited supply and constant demand. In investing part of your wealth in gold, you preserve your power purchase regardless of the context.

Freedom, accessibility and liquidity

A last advantage that this asset gives us, and not the least, is its liquidity. It can be easily bought or sold in the financial markets of the whole world. It also transcends the world of currencies, since it will have as much value here as on the other side of the world. Gold is immutable through the time and space. Solid and liquid at the same time, there are a multitude of options for invest in gold, ranging from physical bullion to exchange-traded funds (ETFs) backed by gold. This makes gold accessible to investors from all walks of life, regardless of their level of experience or amount of investment.

However, it is important to note that investing in gold involves also risks and requires in-depth analysis before taking any actions. In the second part of this series, we will explore the different forms of Investing in Gold and Important Considerations account.

See you next month for a new step in our gold rush!