Price at a glance

In April 2024, silver emerged violently from the top of a consolidation box that had begun in July 2020.

Source: Tradingview

The gray metal then retraced back into the box, closing April with a monthly gain of 6.5%. The breakout was confirmed in May, with a monthly gain of 13.7% and a peak at 29.9 €/ounce. Silver metal is currently trading around €27/ounce, levels we haven't seen since 2012.

Since the start of 2024, the gray metal has gained 27.9% at the time of writing. It is currently trading above the upper Bollinger Band. In the short term, we could see profit-taking and a correction that would re-test the resistance that has become support around €25/ounce.

Or at the very least, a consolidation that would allow us to digest the sharp rise of the last three months and tighten the Bollinger Bands in preparation for the next leg up. In the long term, the trend does look bullish, and the odds are in favor of a return to the all-time high of €34/ounce.

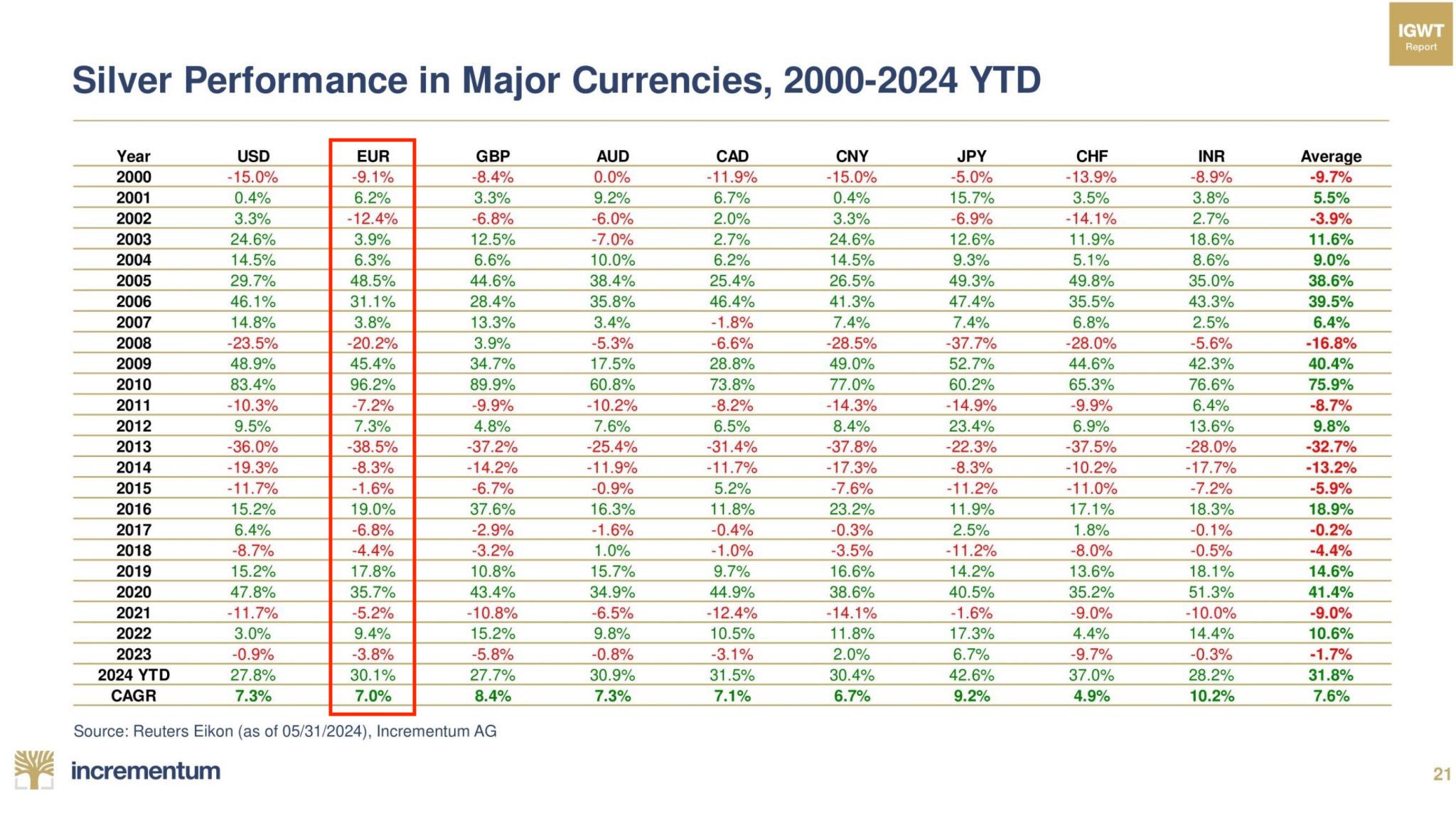

Silver performance 2000-2024

Source: Incrementum AG

The table above reminds us that silver metal is more volatile than gold, but capable of more violent acceleration. Between 2000 and 2023, the gray metal posted an average annual performance of 7% in euros, versus 8.2% for the yellow metal.

On the other hand, we note that silver metal recorded an annual gain of 96.2% in 2010 and 35% in 2020, versus 38.6% and 14.8% respectively for gold.

Of course, it can also be more violent on the downside, with a decline of 38.5% in 2013, versus 30.9% for the yellow metal.

Supply and demand

Source: The Silver Institute

The table above shows that demand for silver will exceed supply in 2021, 2022 and 2023. According to Silver Institute projections, this gap could widen by 17% in 2024. Mining production declined in 2023 and looks set to continue to do so in 2024.

Demand from the photovoltaic sector continues to grow, while investment demand declines... for now. For Chen Lin, founder of Lin Asset Management, China is one to watch, with its significant influence on the silver market.

In a recent interview with Kitco News, Chen Lin pointed out that, according to the Shanghai Futures Exchange, silver stocks are at their lowest level in 10 years. If we add to this the 10% silver price differential between Shanghai and New York, this points to a solid buying trend on the part of the Middle Kingdom.

The same thing happened with gold when Chinese investors started buying massively last September. This led to a significant price differential in Shanghai.

Now it's silver's turn, revealing massive transfers of grey metal from West to East. China's role is crucial, as the country increases its silver and copper acquisitions to support its technological and industrial advances.

Moreover, the significant reduction in Shanghai's silver stocks reflects the strength of domestic consumption and investment demand. Once again, China takes the lead.

The influence of Chinese demand and the global supply deficit are factors to be monitored in terms of silver price trends. Not forgetting interest rates, inflation and the price of gold, which will also influence investment demand for silver metal.