On September 4, 2024, Belgian government bonds will mature, opening up new opportunities for various types of investments. This maturity represents a key moment for investors looking to reallocate their assets to other options such as gold. As global markets present increasing risks, this article examines why physical gold remains an indispensable investment option in any portfolio. We will also analyze the financial literature's recommendations on the optimal proportion of gold to include in your portfolio, as well as a practical case of investing in physical gold.

In a world where economic fluctuations and political uncertainties become the norm, gold continues to shine as a symbol of stability and security. It remains an essential safe haven for investors seeking protection against inflation and currency devaluation. Investing in gold is not only about wealth preservation; it is also a diversified strategy that can offer tangible benefits in any portfolio.

1. A More Diversified Portfolio

Gold is an important diversification tool in an investment portfolio. It is known for its often low or negative correlation with stocks. In other words, when stock markets experience a downturn, gold tends to retain or even increase in value. This characteristic helps to reduce the overall volatility of a portfolio, especially when it is heavily composed of stocks. Integrating gold into an investment portfolio contributes to better diversification, thereby improving the overall risk-return ratio.

The graph below illustrates the low correlation between gold and various financial assets over different periods (5, 10, 20, and 30 years), highlighting its key role in portfolio diversification.

Figure 1. Gold has a low correlation with other asset classes.

Source: Sprott. "How Much Gold Should I Own in My Portfolio?" June 26, 2023.

Another way to diversify a portfolio lies in the physical dimension of gold, an attribute not shared by many other assets. Gold, known for its intrinsic value due to its rarity and constant demand, has long been used as currency, which gives it notable trust. Unlike financial or digital assets, gold is immune to hacking or destruction caused by technological failures. It also operates outside financial and banking systems, protecting its value against bank failures and financial crises. Additionally, its density and high value per unit weight facilitate its transport and storage. Finally, the counterparty risk is limited with physical gold: by owning it directly, its value does not depend on another party's ability to fulfill an obligation, which enhances its reliability as an investment.

2. Historical Performance

Since the United States ended the gold standard in 1971, the price of gold has shown continuous growth, as illustrated in the graph below. Moreover, over the past two decades, gold has often outperformed many other major asset classes. For example, U.S. Bonds offered an average annual return of 3.99% over the period 1999-2022, while gold generated an average annual return of 8.36%.

Regarding Belgian government bonds, the latest one-year bond issued in June 2024 offered a gross return of 3.2%. After withholding tax, the net return is 2.24%, highlighting that gold is a more attractive choice.

Figure 2. Gold has outperformed other asset classes (1999-2022).

Source: Sprott. "How Much Gold Should I Own in My Portfolio?" June 26, 2023.

Additionally, the economic magazine Trends-Tendances on July 25, 2024, emphasized that "since January 1, 2000, an investment in gold has yielded much more than an investment in the S&P500." This statement highlights the robustness of gold as a long-term performing asset.

3. Protection Against Inflation

Gold is recognized for its ability to protect against inflation. Unlike many other financial assets that are negatively influenced by macroeconomic variables such as inflation and interest rates, gold retains its value even during economic fluctuations. Studies show that gold provides a hedge against inflation in both the short and long term. When traditional currencies lose their purchasing power due to rising prices, gold remains stable, offering protection against capital erosion.

4. Protection Against Systematic Risk

Gold is often considered a safe haven, making it an attractive asset during financial stress and declining stock markets. When stocks and other financial assets suffer losses due to systematic risk—the risks attributed to market volatility affecting all sectors simultaneously—gold tends to retain or even increase in value. By incorporating gold into a portfolio, investors can reduce their exposure to these widespread losses.

The graph below shows that during various economic and political crises between 2007 and 2023, gold often outperformed U.S. stocks and bonds, confirming its role as a safe haven during periods of instability.

Figure 3. Gold is a safe haven during economic and political instability.

Source: Sprott. "How Much Gold Should I Own in My Portfolio?" June 26, 2023.

5. A Less Risky and More Stable Portfolio

Gold helps to improve the risk-adjusted performance of an investment portfolio, meaning it contributes to reducing the overall risk of the portfolio while maintaining an optimal expected return.

Furthermore, the stability of gold allows for maintaining a dynamic portfolio with a competitive Sharpe ratio (a key indicator measuring the profitability of a portfolio based on the risk taken), reducing the need for frequent rebalancing. In sum, integrating gold into a portfolio helps to stabilize its performance, thereby limiting the need for regular adjustments.

6. Higher Liquidity

Gold has a very liquid market that allows investors to quickly and efficiently convert their gold holdings into cash, which is an advantage compared to other commodities.

Optimal Gold Allocation

For investors looking to diversify their portfolio by including gold but uncertain about the appropriate proportion to allocate, there are clear recommendations from the scientific literature. It is generally advised to allocate between 5% and 20% of the portfolio to this metal. This percentage will naturally vary depending on the other asset classes held in a portfolio and the investment strategy you follow.

By allocating approximately 10% of your portfolio to gold, you can reduce overall risk while preserving expected returns. This strategy takes advantage of the diversification benefits that gold offers, helping to stabilize the portfolio against fluctuations in other assets and thereby improving the overall risk-return ratio.

Practical Example of Investing in Gold

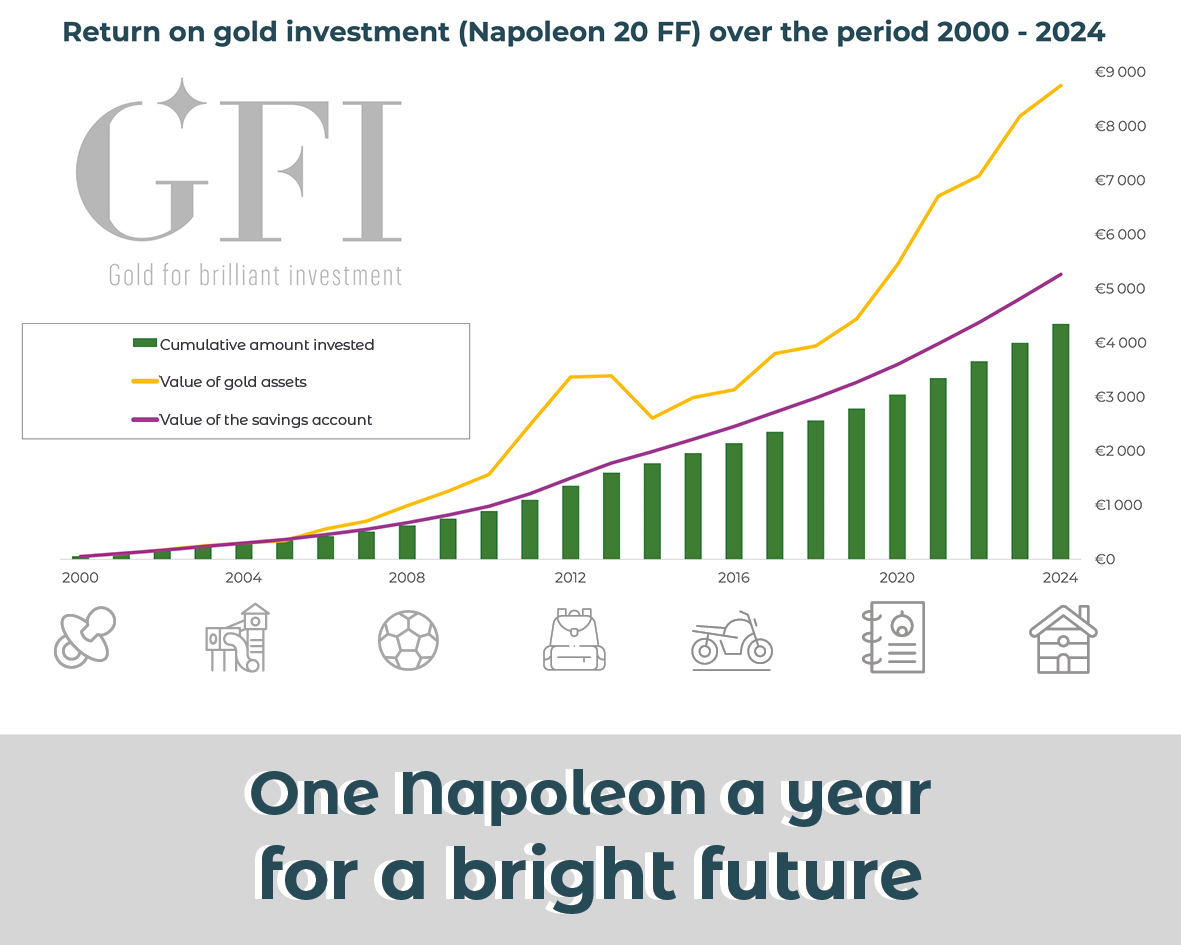

To illustrate a practical case of investing in gold, let's consider a scenario where an investor buys a Napoleon coin of 20 francs each year, from January 2000 to January 2024.

Over this 25-year period, the investor would have accumulated 25 coins, for a total investment of 4,344 euros. Let's compare this strategy to two other scenarios: placing this amount in a savings account with an annual rate of 2%, and investing the entire amount in gold.

-

Savings Account: With an annual rate of 2%, the capital would have reached approximately 5,263 euros in January 2024.

-

Gold Investment: By investing the entire amount in gold, the value of this portfolio would be approximately 8,750 euros, which corresponds to an internal rate of return of 7.4%.

It's also interesting to note that on July 16, 2024, when gold reached a new record high, the value of this asset would have been estimated at 10,500 euros.