Why does the Exter pyramid exist?

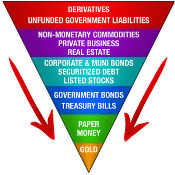

John Exter created this pyramid to illustrate capital movements in times of crisis. It enables investors to visualise the risk inherent in each type of asset and to adjust their investment choices according to the economic context.

Its purpose was to show how, in times of prosperity, capital flows towards riskier assets (top of the pyramid), such as equities, corporate bonds and derivatives. These assets promise higher returns but also carry greater risks.

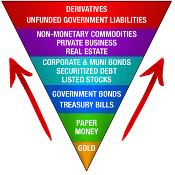

Figure 1 : In times of prosperity, capital tends to move up the pyramid

However, during financial crises, investors turn away from these assets and seek refuge in safer assets (bottom of the pyramid), mainly cash and gold.

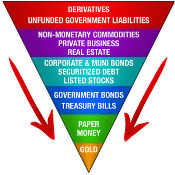

Figure 2 : In Financial Stress, capital tends to move down the pyramid

The pyramid provides a visual understanding of liquidity and risk flows, enabling investors to better manage their portfolios through economic cycles.

The structure of the modern pyramid: from riskiest to safest

Exter's pyramid is divided into several levels, each representing a type of asset, classified according to its liquidity and risk.

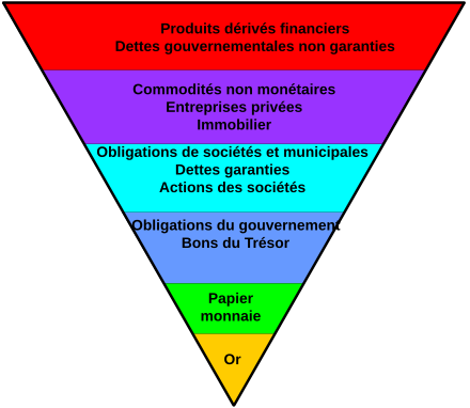

Figure 3 : Modern Exter's Pyramid

- Derivatives and unsecured debt: At the top of the pyramid are the riskiest and least liquid assets. Derivatives (such as options and futures) and unsecured debt are particularly volatile and dependent on counterparties. These assets can collapse rapidly in the event of a crisis.

- Real estate, equities and corporate bonds: This level includes assets such as real estate, listed equities and corporate bonds. Although these assets can offer significant returns during periods of economic growth, they are sensitive to economic cycles, particularly during recessions.

- Government bonds: Government bonds are considered relatively safe because they are guaranteed by governments. However, they carry risks such as inflation or interest rate fluctuations, which can affect their value.

- Currency and deposits: Just before the base, we find cash and cash equivalents, such as banknotes or short-term deposits. These assets are considered safe assets due to their high liquidity.

- Gold: Gold is at the base of Exter's pyramid because of its historical role as a store of value. Unlike paper currencies or other financial assets, gold has no counterparty risk. It is not dependent on any issuer and is not affected by bank failures or liquidity crises. This is why, in times of great economic uncertainty, gold becomes a safe haven for investors seeking to preserve their wealth. As financial markets become more volatile and public debt increases, gold plays a central role in modern investment strategies, particularly for those seeking protection against inflation and economic crises. Periods such as the great financial crisis of 2008 or the current market uncertainty of 2024 illustrate this phenomenon well.

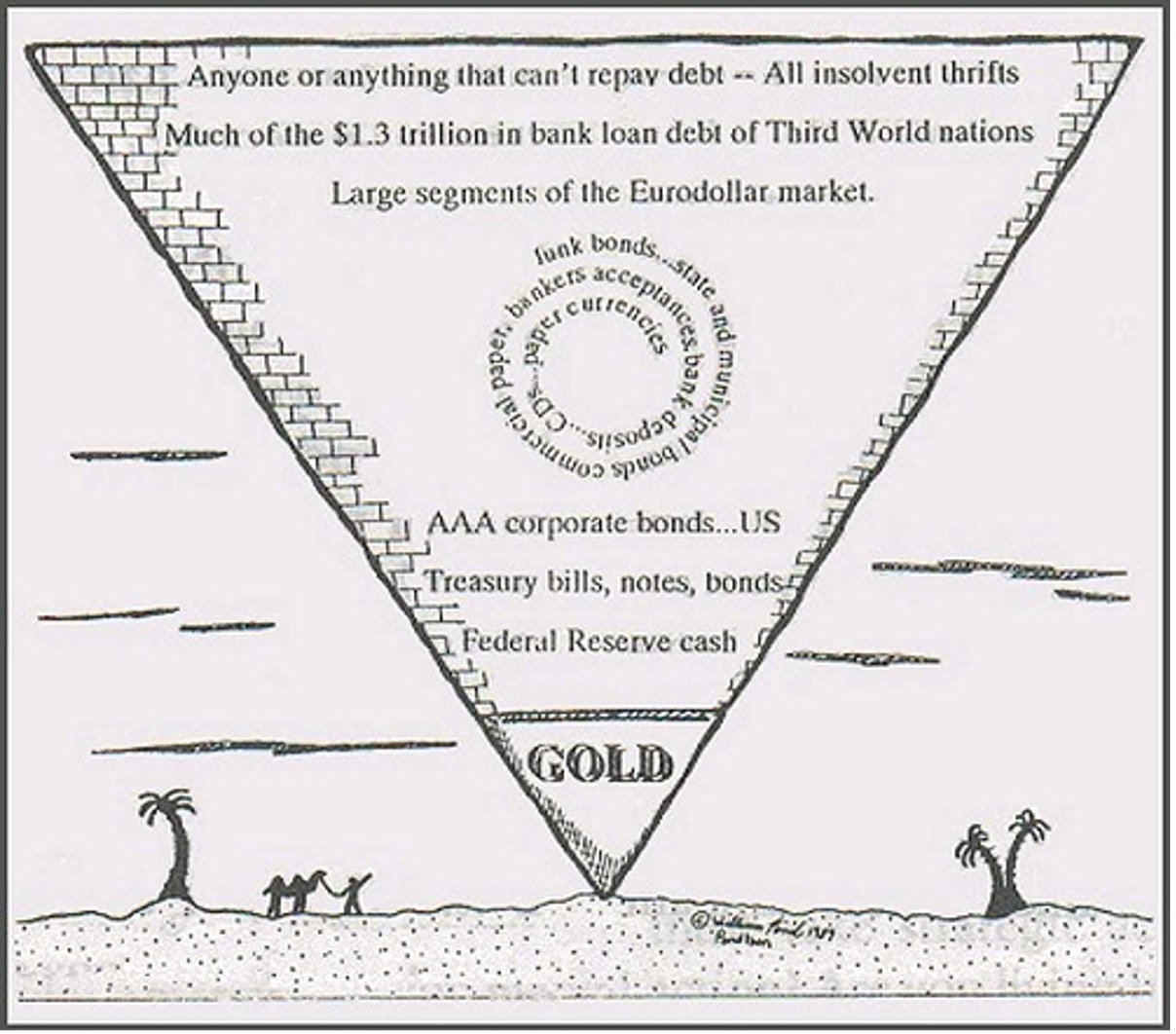

Evolution of the Pyramid over the years

Since its creation, Exter's pyramid has evolved to reflect new economic and financial dynamics, in particular the emergence of complex financial instruments. Today, at the top of the pyramid are derivatives and unfunded debt, instruments that are far riskier than those Exter originally envisaged. Derivatives, such as options, swaps and futures, are highly volatile assets, often relying on massive leverage and multiple counterparties, which increases their fragility.

One of the main changes since the original pyramid is the increasing size of these risky assets. Derivatives now represent colossal theoretical amounts, far exceeding national economies in terms of notional value. This means that any economic shock in this asset class could have devastating effects on the markets as a whole.

In addition, government debt has also become an important part of the current pyramid. Governments are borrowing massively, creating debt which, although perceived as relatively safe, is increasingly subject to inflation and default risks, particularly in the most heavily indebted countries. As a result, investors are becoming more cautious and seeking safe havens such as gold, which remains unchanged at the base of the pyramid.

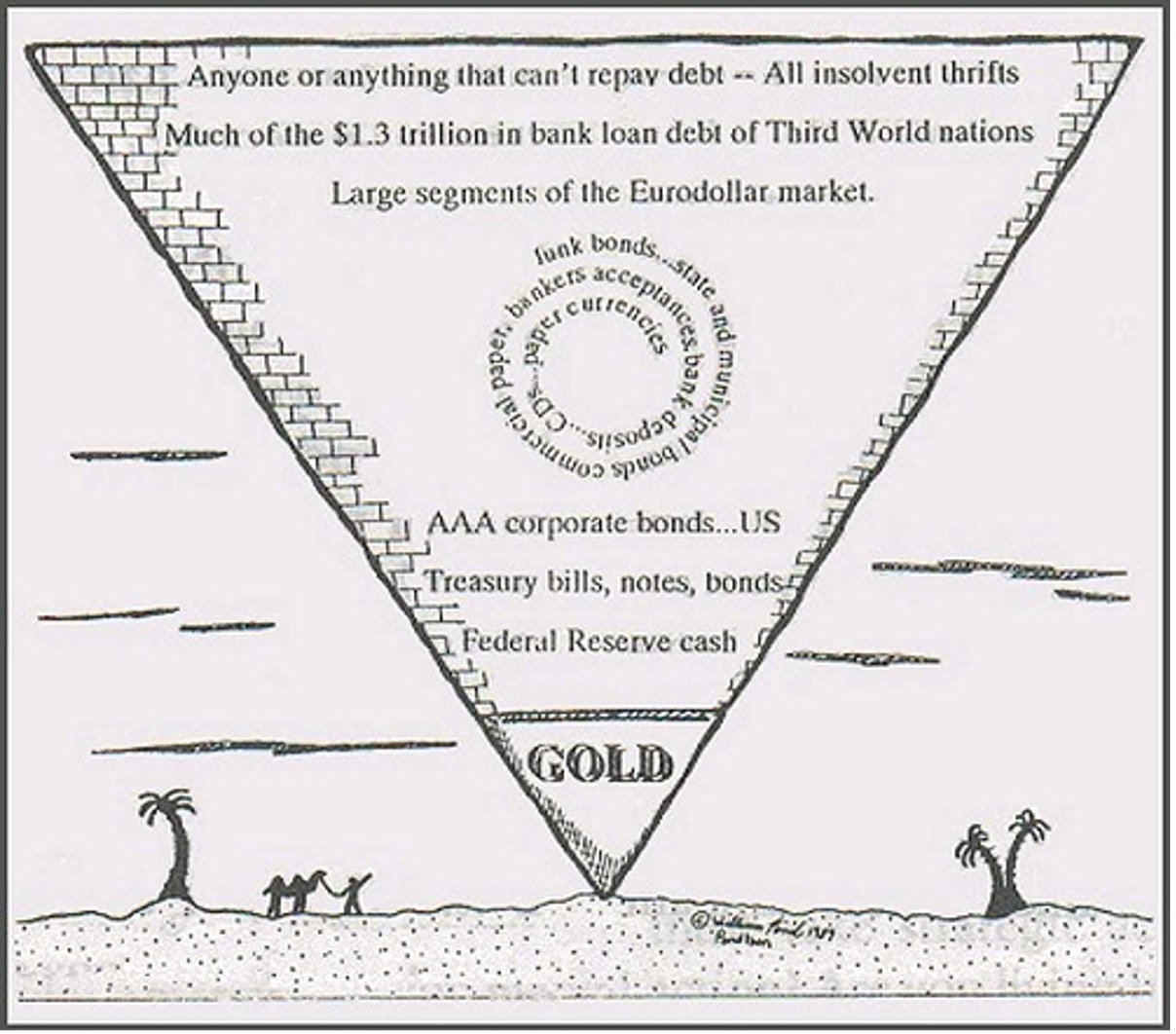

Figure 4: John Exter's original Pyramid of assets

Exter's modern pyramid

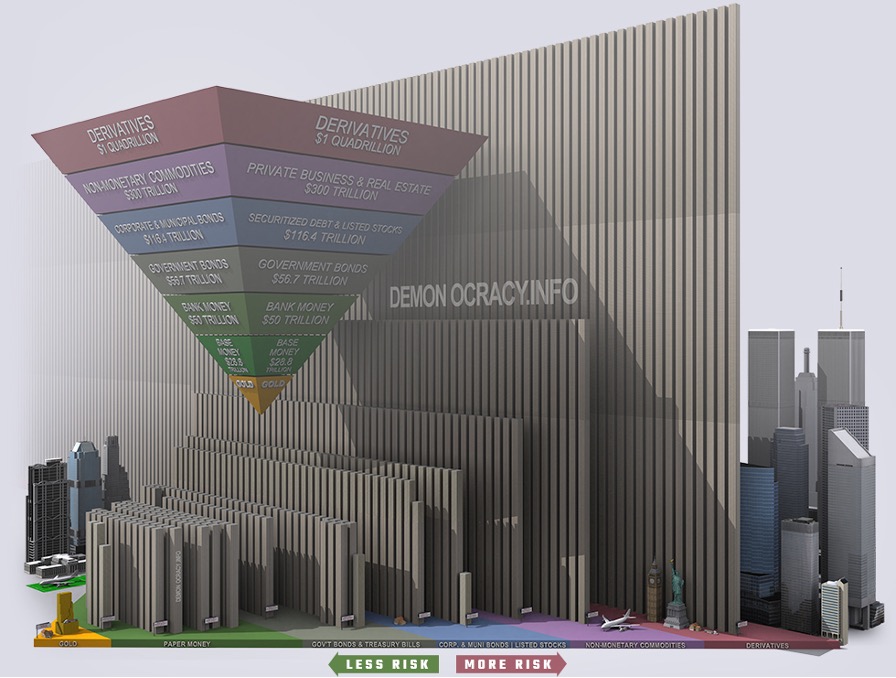

Exter's modern pyramid highlights the disproportion between the value of risky assets and the limited amount of gold and cash available in the world.

Below, you can see a representation of this pyramid. The huge green walls represent stacks of US $100 notes, illustrated on a proportional scale. Each division of this inverted pyramid corresponds to the size or notional value of each asset class.

Look closely and try to spot iconic landmarks such as the Statue of Liberty, the former World Trade Center towers, as well as a representation of the world's entire physical gold reserves, located at the tip of the pyramid.

For all these reasons, John Exter and many experts around the world consider physical gold to be the safest asset to own outright.

Figure 5: Modern Exter's pyramid (source: Demonocracy)

Conclusion: A timeless model for understanding risk

Exter's pyramid remains a fundamental model for analysing financial markets and anticipating capital movements as a function of economic cycles. Whether you are a prudent investor or a financial professional, understanding Exter's asset hierarchy is crucial to navigating a volatile economic environment. Gold plays a key role in this structure, but it is equally important to understand the position of other assets and how they behave in times of crisis.