Demand in Q3 2024

The World Gold Council (WGC) report for the third quarter of 2024 shows that total demand for yellow metal rose by 5% year-on-year to 1,313 tonnes, a record for a third quarter. The value of this demand rose by 35% year-on-year to exceed $100 billion for the first time in history. Central banks are continuing to buy gold, even though we are seeing a 49% fall compared with Q3 2023. More importantly, ETFs (Exchange Traded Funds) posted inflows of 94 tonnes, a turnaround after 9 consecutive quarters of outflows.

Bullish backdrop

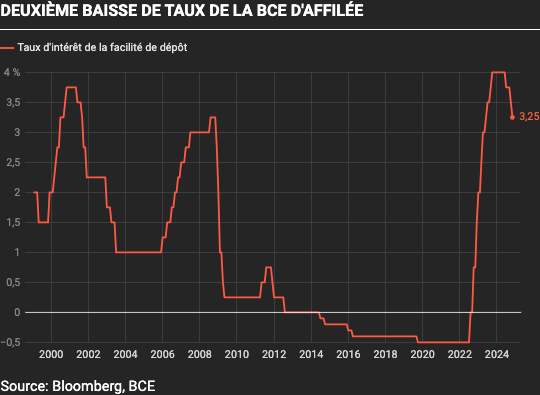

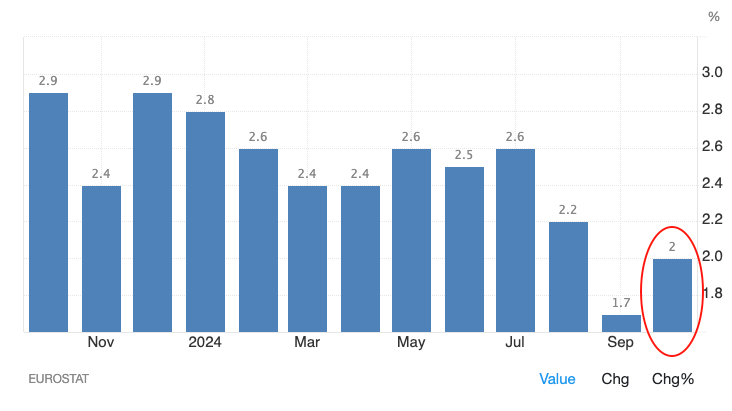

Geopolitical tensions persist and remain a bullish factor for gold (Ukraine, Middle East, Taiwan, etc.), which plays its role as a safe-haven asset. On 17 October, the ECB cut its main key rate for the 2nd time in a row, to 3.25%, given that inflation was below 2% in September.

And their share of the world economy is shrinking, while that of the BRICS is growing. The BRICS control 42% of the foreign exchange reserves of the world's central banks. The ‘Global South’ continues to develop, confirming the organisation of a multipolar world.

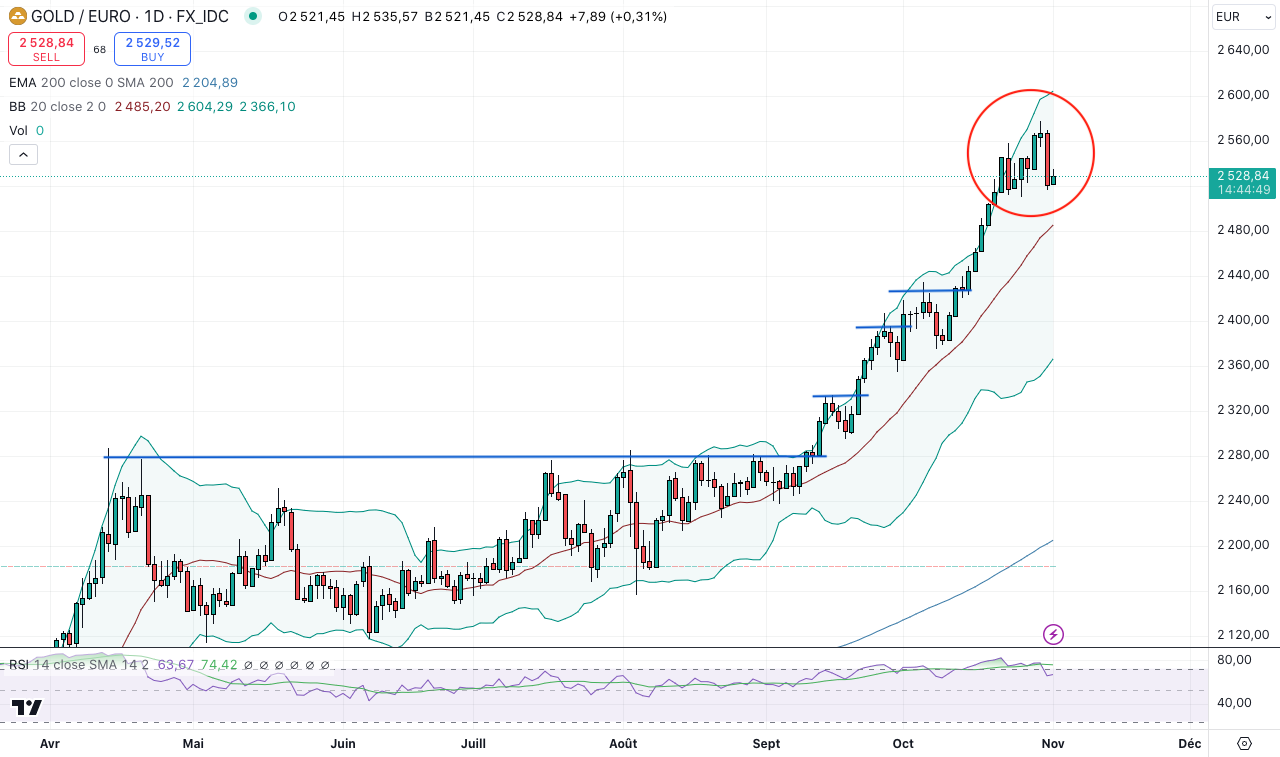

As a result, the process of global de-dollarisation is set to continue and even intensify. Indeed, gold continued to rise in October despite a strengthening US dollar, indicating a growing loss of confidence. For the BRICS, gold is the main potential alternative to the US dollar. They are currently the biggest buyers. In the West, the yellow metal is still relatively rare in portfolios, despite its current performance.

But what will happen when a turnaround begins?

This suggests that gold still has plenty of room for improvement. Having said all of the above, we should not forget to recall the most important point. The fundamental factor behind gold's rise is the loss of value of money. Money creation generates inflation and money loses its value, because a larger quantity of money drives out an unchanged quantity of goods and services. Against this financial backdrop, gold remains a must-have asset, even if short-term declines, corrections and consolidations cannot be ruled out, and are even welcome if a healthy bull market is to be maintained. More and more investors will see these as buying opportunities.