The price of gold in 2024

Gold denominated in euros recorded an annual performance of +35% in 2024!

You have to go back to 2010 to find a better performance.

Source: Tradingview

The chart above shows that the year has been split into two bullish legs. A consolidation formed a stair step (cup and handle) between April and September and we are currently in a second consolidation which began at the end of October. The yellow metal closed an exceptional 2024 at €2534/ounce, with a high in November of €2606/ounce!

The determining factors

Gold purchases by central banks played an important role in overall demand in 2024. The yellow metal represents a safe asset in times of economic uncertainty. We are still awaiting data for December, but 2024 will almost certainly mark the 15th consecutive year of net central bank purchases. In November 2024, central banks bought 53 tonnes of gold.

According to the World Gold Council's official data as at 30 November 2024, Poland, Turkey, India and China formed the Top 4 largest buyers in 2024. In Q3 2024, we also saw a resumption of buying by ETFs (Exchange Traded Funds) after several quarters of selling.

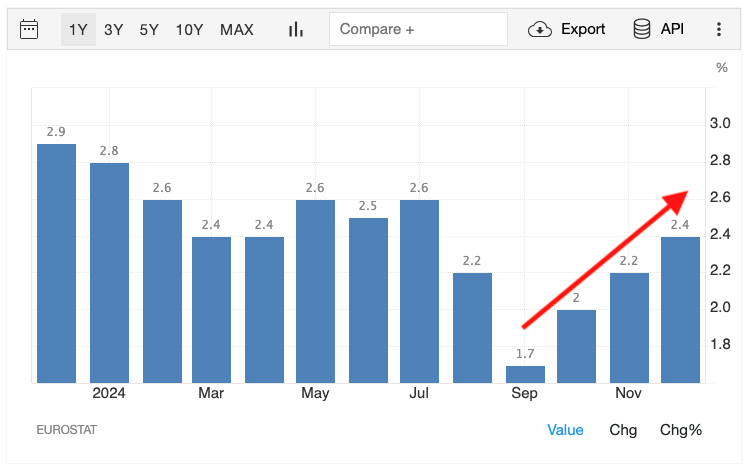

ETFs backed by physical gold are a major player in the demand for gold. Institutional and individual investors use them to position themselves in the gold market. Inflation has fallen relative to 2023, but has not really managed to settle below the ECB's limit of 2%. After bottoming out at 1.7% in September 2024, we are not surprised to see inflation pick up again in the fourth quarter as a result of the ECB's interest rate cuts.

Source: Trading Economics

In 2024, the ECB cut its main key rate four times. It fell from 4.50% to 3.15%.

Source: Trading Economics

Lower interest rates are traditionally favourable for gold. Lower yields on interest-sensitive assets make gold more attractive. And vice versa. But one new element worth remembering is the behaviour of the yellow metal when the ECB raises rates in 2022 and 2023. We could have expected gold to come under pressure from interest rates, even though it performed 6% and 9.7% respectively in euros.

The silver price in 2024

Silver metal denominated in euros recorded an annual performance of +28% in 2024! This is its best year since +35% in 2020.

Source: Tradingview

As with gold, we are seeing a year split into two bullish legs followed by a correction. The grey metal closed 2024 at €27.9/ounce, with a peak of €32.3/ounce. Unlike gold, silver metal has not yet caught up with or surpassed its all-time high of €34.1/ounce in 2011, but it has come very close.

The determining factors

Silver is more of an industrial metal than a monetary one. And demand from industry rose in 2024 by +7% to 700 million ounces (according to data from the Silver Institute as at 12 November 2024). Demand from the photovoltaic sector in particular rose by 20%. Despite a 15% fall in demand for physical investments, mainly in the United States and then in Europe, ETFs are well on their way to recording their first year of buying for 3 years. At the end of October, their global holdings were at their highest level since July 2022, up 78 million ounces, or 8%, on the end of 2023. Jewellery demand will have grown by +5% in 2024, with India the main contributor. But most importantly, the world silver market in 2024 will be in deficit for the fourth year running! In fact, demand has outstripped supply since 2021.

What does 2025 hold in store?

The year 2025 is shaping up to be a very uncertain one, both economically and geopolitically. According to analysts at Bank of America, the ECB is likely to keep up the momentum with successive rate cuts until the deposit rate is set at 1.5% in September 2025.

In Belgium, inflation forecasts have once again been revised upwards. The Federal Planning Bureau expects average inflation to reach 2.5% in 2025. For its part, the US Federal Reserve (Fed) is also expected to continue cutting rates, but the frequency and scale of these cuts remain a mystery. Cutting rates too sharply could cause inflation to rise more sharply. The aim of rate cuts is to stimulate economic activity by reducing the cost of credit.

If this works, it will also be at the cost of even more debt. The outlook for growth in the eurozone remains weak, at around 0.3%-0.4%, and the Franco-German motor is at a standstill. And the euro continues to weaken against the US dollar. This environment should prove favourable for gold measured in euros. In the United States, the arrival of Donald Trump, who will take office on 20 January 2025, is causing concern. It is difficult to know exactly how the measures announced will be applied.

The threat of imposing customs duties on countries that continue to de-dollarise could put the brakes on gold purchases by certain central banks, or lead them to exercise greater discretion. Such a trade war could have inflationary effects that would weigh on the Fed's rate-cutting policy. On the geopolitical front, it is also difficult to know whether Donald Trump will succeed in putting an end to the war in Ukraine as he has announced. If he does, gold could ease in a global context that is easing. But in Europe, the leaders are openly bellicose.

At the beginning of December 2024, Donald Tusk, the Polish Prime Minister, whose country holds the rotating Presidency of the Council of the EU until the end of June, declared: ‘We are living at a very critical moment in our modern history, in Europe and in the world. The ‘post-war’ era is over, and we are now living in a ‘pre-war’ period.’ Then NATO Secretary General Mark Rutte added: ‘The danger is closing in fast. What is happening in Ukraine could happen here too. It's time to move to a wartime mindset.’ In Europe, we are also witnessing the rise of political leaders and parties opposed to the European Union.

In short, we are moving forward in a thick fog.

In the face of such uncertainty, and without any real purge or overhaul of the global system, euro gold should continue to play its role as a safe-haven asset, attracting a growing number of investors who are currently absent from the gold market. Now, a consolidation or even a correction in the short/medium term cannot be ruled out. Normally, it takes time to digest such a major annual rise. Let's see how the yellow metal handles the current consolidation and whether it emerges from it on the upside or the downside. Silver is likely to continue the upward momentum that began in 2024, with volatility potentially more erratic than that of gold. If it were to catch up with its all-time high, we could imagine that it would take some time to work up to this level before breaking through. The start of the year is also a good opportunity to take a step back and look at the annual performance of gold and silver since 2000 (adjusting for 2024 performance).

Source: Incrementum AG

Source: Incrementum AG