The S&P 500 index ended 2024 up 33.6% in euros (which fell by 6.5% against the dollar over the year), following a 20.2% gain in 2023, marking its best two-year performance since the beginning of the century. The rise was driven by large tech stocks exposed to artificial intelligence (AI). Nvidia gained 189%, while Meta rose by 76%. European markets lagged behind with mixed performances. Despite the impressive performance of the DAX (+18.9%), the Stoxx 600 increased by only 9%, weighed down by a flat CAC 40. With a 32% gain, Hong Kong’s Hang Seng ended a four-year losing streak. However, emerging markets (+15%) are at their lowest levels relative to developed markets in 20 years. The bond index posted a total return of 4.9%, still down 4% since 2021, excluding inflation.

From a geopolitical perspective, the world is becoming increasingly multipolar, but for investors, it is becoming more unipolar. In the past, U.S. market gains would lift other stock exchanges. Today, however, the U.S. market seems to draw all investment flows toward itself. The weight of U.S. equities in the MSCI World index now stands at 74%, compared to less than 50% a decade ago (while the U.S. economy accounts for 27% of global GDP). Global stock indices now move to the rhythm of the U.S. economy and are heavily dependent on the performance of a handful of stocks—the so-called "Magnificent Seven," which rose 78% in 2024 compared to 24% for the remaining S&P 493.

Investors like to believe that fundamentals determine prices and sentiment, but there comes a point when flows begin to influence fundamentals. Increasingly, the efficient market hypothesis is being challenged by the explosive growth of passive investment funds. Last year, active managers once again saw over $400 billion in outflows, with funds shifting toward ETFs that tend to overweight the Magnificent Seven. This phenomenon explains the sharp rise in the S&P 500’s concentration, where the weight of the MegaCap-8 (MAG 7 + Netflix) has risen from 19% (accounting for 14% of earnings) to 32% (representing 22% of earnings) in just two years.

Dominating the mental space of global investors, the U.S. is overweighted and overvalued relative to other markets to an unprecedented degree. While part of this enthusiasm is justified by higher profitability, it is worth noting that half of the S&P 500’s 2024 gain stems from valuation multiple expansion (from 20x to 22x P/E), a 30% premium to its historical average. In contrast, most major indices trade at 13x or 14x P/E. The MegaCap-8 valuations are even higher at 29x P/E, based on an expected net profit margin of 25%, compared to just 12% for the S&P 493.

The most common justifications for such valuation and profitability gaps are the anticipated productivity boom in the U.S. economy driven by AI and the disproportionate benefits the MAG 7 are expected to derive from this new technology. While we do not dispute these arguments, the scale of expectations raises questions. In a recent paper, the latest Nobel Prize in Economics laureate, D. Acemoglu, estimates AI-related productivity gains at just 0.5% of GDP per year over the next decade. As for expected profits, the gap between Nvidia’s projected 2026 revenue and the anticipated revenue from hyperscalers’ AI activities amounts to $400–500 billion if they want to maintain gross margins at 50%. Their investment pace is $200–250 billion annually, but revenues so far fall short. For example, Microsoft estimates its AI-driven revenues at just $10 billion per year.

Finally, there is the Trump effect. Investor sentiment is extremely positive regarding the new administration’s economic program, and the Atlantic divide has widened due to political challenges in Germany and France. However, much of Trump’s electoral agenda may go unimplemented, and some aspects might not be as beneficial as they appear. Higher tariffs could reduce global growth, increase inflation, and, all else being equal, keep interest rates higher, exacerbating fiscal difficulties. Promises of new tax cuts also contradict the stated aim of reducing the trade deficit and could create tensions in bond markets.

Against the consensus, we believe it is better to exercise caution rather than euphoria at the start of the year and to underweight the U.S. market relative to its benchmark. Style-wise, it is more critical than ever to maintain diversification and avoid holding only large-cap growth stocks (especially U.S. ones). Trump’s unpredictability is likely to generate volatility, and with surveys showing that both private and institutional investors are heavily overweight U.S. equities compared to historical averages, market concentration poses a risk in the event of a trend reversal.

The market is worried about the US deficit: since the Fed began cutting rates by 1%, long rates have risen by 1%.

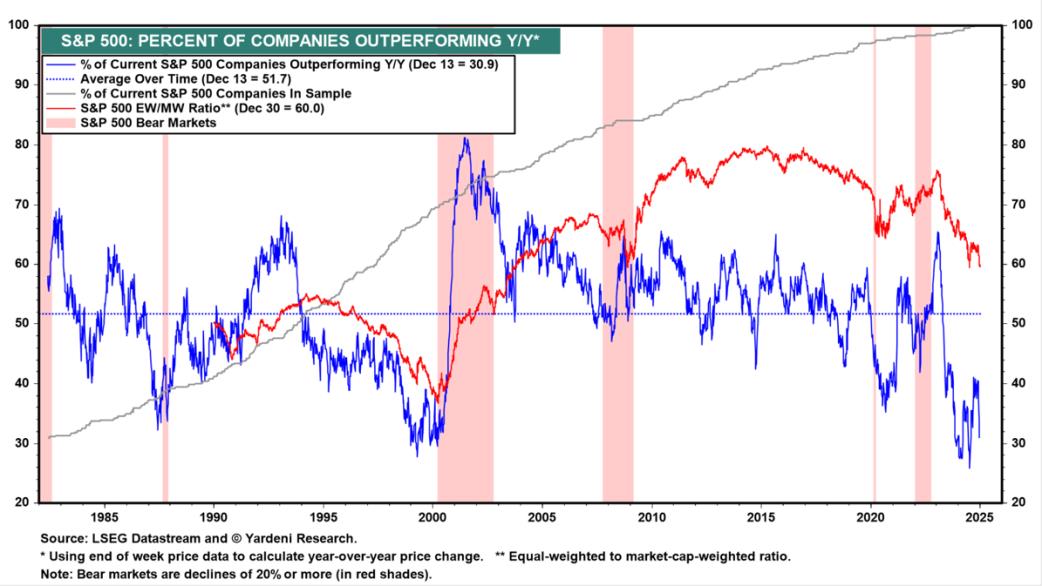

Concentration of performance: long underperformance of the S&P 500 weighted versus the S&P 500 (in red) and small number of companies outperforming the S&P 500 (in blue).

Article written by Bertrand Veraghaenne.

Bertrand Veraghaenne has over 25 years' experience in the financial markets. He started at Arthur Andersen in 1997, joined Petercam in 2000 as a financial analyst, then headed the financial analysis department of Petercam Asset Management in 2005, contributing in particular to the creation of an emerging fund.

In 2009, he became Head of Financial Analysis at BNPP-TEB in Istanbul, before joining Private Banking in 2010 as Chief Economist at Banque Transatlantique (CIC-Crédit Mutuel), working between Brussels and Paris. In 2013, he joined JPMorgan Private Bank, holding key positions in London and Luxembourg as Investment Specialist for UHNWI clients in Benelux and Denmark.