Saving doesn't pay off anymore. Worse, we will see that it costs money.

It's the world upside down.

Despite everything, savings are breaking records.

Outstanding current accounts are also increasing: from 252 billion euros in December 2019 to 342 billion in October 2021 (+37%).

With a return of 0.11% per year, some account holders no longer bother to save.

In total, this makes almost 650 billion euros of bank deposits in Belgium.

And these 650 billion are melting "economically" like snow in the sun!

Inflation, that "invisible" tax!

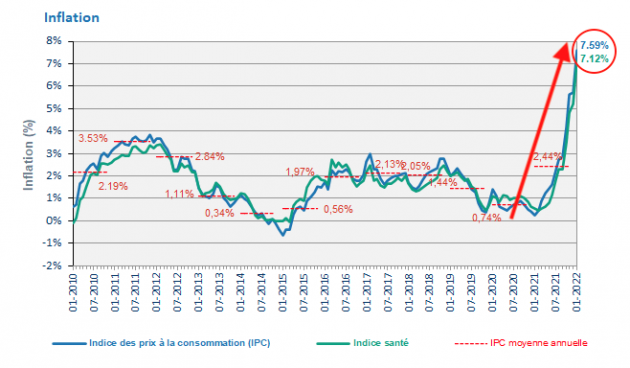

Yes, it is the great return of inflation induced by the (sustainable?) increases in energy prices.

https://statbel.fgov.be/

Inflation is a real cancer for your savings.

To see this, you need to know the real interest rate with a very simple calculation:

Real interest rate = Nominal interest rate - Expected inflation

Let's take the nominal rate of 0.11% (base rate + loyalty bonus) and inflation at 6%.

Your actual return is 0.11% - 6% = -5.89%

Over the course of the year, your 10,000 euros became 9,411 euros in terms of purchasing power.

Inflation is indeed an "invisible" tax.

How to explain this record of savings?

Indeed, why save so much if it costs money?

It is probably a combination of fear for the future and a lack of information.

Many have not yet understood the difference between price and value, the importance of calculating in real terms and the ravages of inflation.

Others may console themselves by saying that this is the price to pay to have their money safe in the bank and quickly accessible if necessary. Which is understandable but...

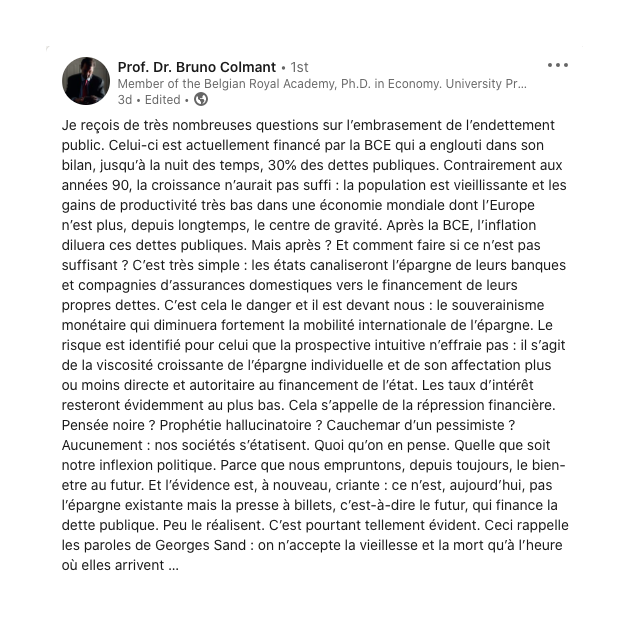

Here is a message from Bruno Colmant, a renowned economist, posted on the LinkedIn social network on Monday, February 7, 2022.

Bottom line:

First, inflation will dilute the states' astronomical debts (and your wealth by the way), but that may not be enough.

Then, the States will probably have to puncture the savings and life insurances of the citizens to pay off their debts.

This is ultimately called financial repression.

Nevertheless, you may be resigned to the fact that there is nothing you can do anyway. This is worth thinking about.

What are the solutions?

It's decided! You don't want to lose money every year.

Fine, but what can you do?

Real estate? It's a real asset, but prices are very expensive and the risk of tax rage is very real via a major tax reform of the sector that they are announcing for 2025.

Stock markets? Valuations are high. Money printing has inflated the indices. So yes, it can still go up as long as central banks are behind it. However, the risk and volatility is high.

Crypto-currencies? Volatility is very important. We don't yet know how Bitcoin will behave in a financial crisis (similar to Nasdaq?). Scams are legion. It can enter the basket of solutions, but with great caution and solid knowledge. And you have to keep a close eye on the evolution of taxation. In addition, banks are increasingly vigilant about transfers emanating from crypto-currency platforms as the article in french speaking newspaper "Echo" this weekend still attests.

Art ? Diamonds? Vintage cars? Watches? These are real assets, yes. But they are mostly insider markets, sometimes with very little liquidity. You have to know them well to make the right decisions.

All these asset classes can be part of a global diversification strategy if you master the subject, but the most important thing is to do things in the right order.

And today, any strategy for protection and diversification must also include holding physical precious metals, including gold, in reasonable proportions.

Gold : it's the basis

Gold has been a universal currency for thousands of years, protecting us against negative real rates and a risk on currencies (euro, dollar...).

History reminds us that all the uses of money printing ended the same way: the destruction of paper money.

Investment gold is a simple and liquid market.

Of course, a purchase of physical gold and silver cannot be improvised.

It is necessary to prepare certain points upstream: the allocation of the portfolio, the storage, the resale, the possible taxation...

But it remains much less tedious than buying real estate, stocks, crypto-currencies or art.

The easiest way is to choose known and recognized investment coins or bars from a serious broker like GFI GOLD.

Gold is suitable for all sizes of assets, from the largest to the most modest.

With a savings of 1,000 euros, you can already buy a few coins and store them in a safe place with our GFI SAFE solution if you wish.

Gold is the insurance of the portfolio that can be used to compensate for a possible higher risk on other asset classes.

Indeed, gold is one of the components of the portfolio whose allocation varies according to the context and the risk profile of each individual.

Gold is liquid: You can resell it very easily. As a market maker, GFI Gold will pay you the amount into your account the same day.

And if you have opted for our ultra-secure storage solution GFI Safe outisde of the banking system, you can even buy and sell your gold without having to leave your home.

>>> If you buy and store gold with us in February, you get three months free storage.

>>> Contact us to discover concrete solutions that you can quickly implement.

The GFI team

***

Sources:

https://www.nbb.be/fr/search/bcs/%26eacute%3Bpargne

https://stat.nbb.be/Index.aspx?QueryId=5781&Lang=fr

https://stat.nbb.be/Index.aspx?DataSetCode=CREDINSCORP&lang=fr#

https://www.febelfin.be/fr/chiffres

https://statbel.fgov.be/fr/themes/prix-la-consommation/indice-des-prix-la-consommation

https://statbel.fgov.be/fr/themes/prix-la-consommation/indice-des-prix-la-consommation